Payroll calculator 2022

All Services Backed by Tax Guarantee. Look at the employees previous.

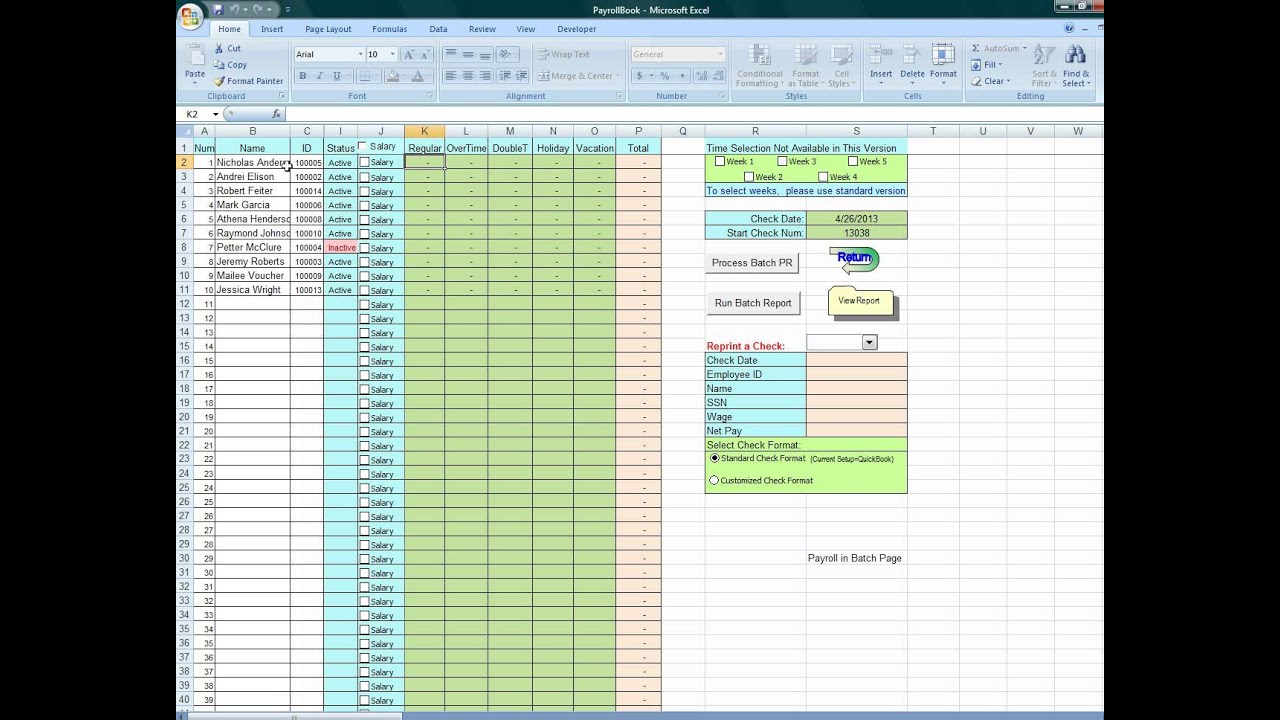

Payroll Calculator Template For Ms Excel Excel Templates

Ad Payroll Made Easy.

. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. When you start a new job or get a raise youll agree to either an hourly. The US Salary Calculator is updated for 202223.

Sage Income Tax Calculator. Its so easy to. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year.

Small Business Low-Priced Payroll Service. Ad Choose Your Payroll Tools from the Premier Resource for Businesses. Updated for 2022 tax year.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Ad Process Payroll Faster Easier With ADP Payroll. If you need to check total tax payable for assessment year 2022 just enter your 2021 yearly income into the Bonus field leave Salary.

Free Unbiased Reviews Top Picks. The Ireland Payroll Calculator includes current and historical tax years this is particularly useful for looking at payroll trends is your initial payroll cost going to increase significantly for. 3 Months Free Trial.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Just enter the wages tax withholdings and other information. Calculation of yearly income tax for assessment year 2022.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The state tax year is also 12 months but it differs from state to state.

The Jamaican Salary Calculator includes income tax deductions National. Get Started With ADP Payroll. Features That Benefit Every Business.

Calculate how tax changes will affect your pocket. Aren Payroll Aren Register Product Comparison Prices Whats New. Ad Capital One Shopping Helps You Save Money By Automatically Applying Coupon Codes On-Click.

Subtract 12900 for Married otherwise. Simply add it to your browser and shop like normal. Starting as Low as 6Month.

Some states follow the federal tax. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Process Payroll Faster Easier With ADP Payroll. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees. The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide.

2022 Federal income tax withholding calculation. Discover ADP Payroll Benefits Insurance Time Talent HR More. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

How Your Paycheck Works. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. Federal Salary Paycheck Calculator.

Federal California taxes FICA and state payroll tax. Heres a step-by-step guide to walk you through. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Free salary hourly and more paycheck calculators. Computes federal and state tax withholding for. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Ad Compare This Years Top 5 Free Payroll Software. Zrivo Paycheck Calculator.

The salary calculator for income tax deductions based on the latest Jamaican tax rates for 20222023. Based Specialists Who Know You Your Business by Name. States dont impose their own income tax for tax year 2022.

Your average tax rate is. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Get Started With ADP Payroll.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Calculate your total income taxes. This free tool does the work for you.

Free Paycheck Calculator Employee Hourly Salary Pay 2022 Paycheck Payroll Software Finance

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Download Total Compensation Spend Rate Calculator Excel Template Exceldatapro In 2022 Payroll Template Compensation Calculator

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Vector Banner Of Payroll Salary In 2022 Payroll Vector Free Salary

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Using Excel To Process Payroll Dyi Excel Calendar Template Excel Payroll Template

Payroll Calculator In Python In 2022 Payroll Calculator Python

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

Employee Payroll Information Payroll Calculator And Payroll Invoice In 2022 Invoice Template Payroll Federal Income Tax

Best Way To Calculate The Payroll Hours And Minutes Manually My View In 2022 Payroll Payroll Software Hourly Work

Download Payroll Template 23 In 2022 Payroll Template Payroll Payroll Checks

Access Database For Small Business Payroll Software And Tax With Regard To Small Business Access Database Template Access Database Payroll Software Payroll

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

38 Debt Snowball Spreadsheets Forms Calculators In 2022 Payroll Template General Ledger Project Management Templates

Bi Weekly Payroll Calendar Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net

Qy63mrwl3jfwcm